We can smell the heat on the shop floor when a forklift drops a pallet of steel. We can hear it in a grocery aisle when a shopper pauses at a higher price tag. Tariffs do that. They move like a front rolling in—quiet at first, then wind, then rain. Today, we’ll walk through what tariffs are, how they change, what they mean for prices, and how we can plan instead of panic. We’ll keep it simple. We’ll keep it useful. And we’ll do it together.

What a Tariff Really Is (And Isn’t)

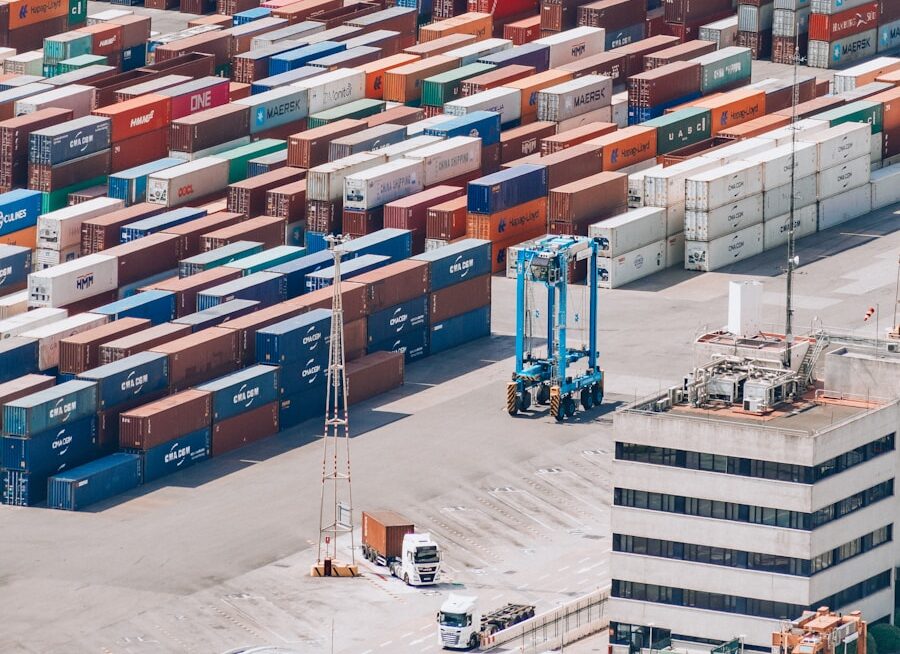

A tariff is a tax on imported goods. That’s the clean definition. But it works like a gate fee at the border. When a shipment comes in, a percentage gets added to the cost. That fee gets paid by someone in the chain—importers, distributors, or retailers—Royal News and some of it, or all of it, often lands in the price you and I see.

A tariff is not a ban. Products can still come in, but the price math shifts. If the fee is small, the change may hide inside margins. If it’s big, it shows up on the shelf. In other words, a tariff turns the cost dial. It does not flip the on/off switch.

Take-home line: A tariff is a price add-on at the border that often travels to the checkout.

How Tariffs Become News

Tariff news breaks in waves. First, a hint. Then an official notice. After that, the details. The timing matters. A rumor can move markets, but rules move money. Businesses do not price to rumors for long; they price to rules they can read.

Here’s the normal flow:

- A policy signal or speech raises the idea.

- A proposal appears with product lists or categories.

- Public comments or hearings may refine the list.

- Final rules land with dates, rates, and codes.

If you sell or buy affected goods, that timeline is your calendar. Instead of waiting for the final bell, we can prepare at each step. That’s how we trade fear for focus.

Take-home line: Watch the steps, not just the headline. Each step is a chance to plan.

Why Tariffs Happen

Tariffs serve goals. Sometimes they’re used to push for fair play in trade. Sometimes they’re used to protect a key industry, like steel or chips. Sometimes they’re used to press for changes in another country’s rules. You don’t have to agree with the reason to understand the move. And understanding helps.

Think of tariffs as tools in a big toolbox. They can fix a dent or bend a frame Fox News Election Coverage. Results depend on where and how they’re used, and for how long.

Take-home line: Tariffs are tools with aims. The aim explains the pressure points.

Where Costs Show Up (Follow the Chain)

Tariffs touch more than the first importer. They ripple. Let’s follow a simple chain.

- Importer: Pays the tariff at the border.

- Distributor: Adjusts the list price to hold a margin.

- Retailer: Re-prices or adds a surcharge.

- Customer: Sees a higher price or fewer promos.

But that’s not all. If a tariff lands on a part, not the finished good, the effect shows up later—inside the price of an appliance, a trailer, a tool, or a motor. The longer the chain, the slower the impact, but the wider the spread. Instead of a single spike, you get a steady climb.

Take-home line: The longer the supply chain, the more places a tariff can hide before it reaches the shelf.

Sectors That Feel It First

Metals and Machinery

Steel and aluminum costs feed into racks, HVAC, vehicles, tools, and frames. When duties rise, the price floor rises, too. Fabricators feel it in quotes. Construction feels it in bids Garden Clean-up Tips for Fall. The hardware aisle feels it last.

Electronics and Motors

Small parts, big effect. Motors, magnets, chips, and wiring harnesses live inside everything now. A tariff on a tiny component can stall a whole product line. Lead times stretch. Substitutes are tricky. Testing takes time.

Home Goods and Building Products

Cabinets, furniture, flooring, and fixtures can get squeezed. If one input jumps—metal fittings, wood products, or hardware—the final set gets repriced. You may see shorter sale windows, fewer coupon codes, and more “temporary surcharges.”

Food and Farming (When Retaliation Hits)

If trading partners answer tariffs with their own, farm exports can slow. When orders dip, local prices soften. At the same time, farm inputs can rise. That spread hurts. Planning and hedging help.

Take-home line: Inputs rise first. Finished goods follow. Agriculture feels it when partners push back.

Inflation: Will Prices Jump?

Some will. Many will drift up over weeks as new shipments arrive. It depends on inventory on hand, the size of the tariff, and who eats how much of the fee. A retailer may hold a price for a while to keep traffic steady. A brand may cut promos instead of list prices. But pressure finds a path. That’s why it pays to watch not just tags, but patterns—shorter sales, tighter bundles, fewer freebies.

Take-home line: Expect pressure, not panic. Prices move in steps, not leaps, How To Easily Grow Pothos in Your Aquarium unless the tariff is huge or sudden.

The Practical Playbook for Importers

This is the page you print, pin, and actually use.

- Map SKUs to HS Codes. Link every product to its tariff code, country of origin, and current duty. Keep it in a shared sheet. Make it the single source of truth. One digit wrong can cost you real money.

- Scenario Price the Top 20. For your bestsellers and mission-critical parts, model +10%, +25%, +50%, and “worst case” duty rates. Set alert thresholds: at X% you reprice; at Y% you re-spec; at Z% you pause.

- Dual-Source the Bottlenecks. You do not need two suppliers for everything. You need a backup for the five parts that can stop your line. Pay a bit more now to save a shutdown later.

- Pre-Clear the Must-Haves. If a rule is likely and you have runway, bring in a lean buffer of A-items. Not the whole catalog—just the few that stop shipping if they run out.

- Tune Freight and Terms. Shift from air to ocean when you can. Consolidate POs. Negotiate Incoterms. Ask for longer validity on quotes. Small wins stack.

- Create a Surcharge Policy. Write it once. Keep it plain. “Due to new import duties on [category], a [X%] surcharge applies to orders placed after [date]. We’ll review monthly and remove it as soon as conditions allow.” Clarity earns trust.

Take-home line: A simple system beats a perfect plan. Build the sheet, price the scenarios, and update weekly.

The Practical Playbook for Exporters and Farmers

- Widen the Buyer List. Even one extra buyer in a different region can soften a hit. It won’t cure a market loss, but it will buy time.

- Use Basic Hedges. Simple tools—put options, forward contracts, co-op programs—can protect a floor price. You’re not betting; you’re building a fence around your margin.

- Check Programs Fast. If relief or support appears, act early. Paperwork is easier when you’re first in line.

- Price in Windows. Keep quotes short and clear. State how long a price stands and when you’ll review it. That reduces renegotiation drama.

Take-home line: Spread risk across buyers, protect price with simple tools, and keep quotes on a timer.

The Practical Playbook for Retailers and Brands

- Adjust Promotions, Not Just Prices. Shorter sales and targeted bundles can protect margin without scaring loyal customers.

- Offer Substitutes. Keep a similar SKU at a friendlier price point. Train staff to point to it. Put it near the first choice on the shelf or page.

- Be Transparent in Plain English. Customers get it. If duties hit a category, say so. Tell people when you’ll review. Honesty lowers churn.

- Mind the Return Policy. Tariff spikes can cause buyer’s remorse on big-ticket items. A fair, clear policy saves headaches and keeps reviews kind.

Take-home line: The right message plus the right substitute keeps carts full and complaints low John Bolton Pleads Not Guilty.

Reading the Announcements Like a Pro

Tariff news can look like alphabet soup. Here’s how we read it fast:

- The List: Which products or codes are covered?

- The Rate: What percentage? Flat fee or ad-valorem?

- The Date: When does it start? Any phase-in?

- The Duration: Is there a review window?

- The Loopholes: Exclusions, licensing, or quotas?

- The Neighbors: Are there partner moves that change the math (export controls, retaliatory duties, or minimum price rules)?

If you only have five minutes, scan those six. Then check your SKU map and update your scenario sheet.

Take-home line: Don’t read every page. Read the few lines that move your price.

Three “What-If” Scenarios You Can Model Today

Scenario A: Big Tariff, Wide Coverage

- Risk: Prices jump across a whole category.

- Move: Trigger your surcharge policy. Allocate limited stock to best-margin channels. Flip on bundles that boost average order value without “feeling” like a price hike.

Scenario B: Narrow Tariff, Big Bottleneck

- Risk: One part gets expensive and scarce.

- Move: Shift mix toward models that use easier parts. Pull forward maintenance on gear that relies on the tight component. Keep a small “spares cabinet” for mission-critical internals.

Scenario C: Phase-In with Reviews

- Risk: Quote whiplash. Customers stall, waiting for clarity.

- Move: Use time-boxed quotes (7–14 days). Offer “lock-in” options with deposits. Send weekly update notes to major accounts until the policy settles.

Take-home line: Model now so you don’t improvise later.

For Everyday Shoppers: How to Navigate the Aisles

We all feel it when tariffs land on things we buy. Here’s a calm, workable plan:

- Prioritize Needs Over Wants. Replace the fridge that’s failing; wait on the fancy add-on.

- Set Price Alerts. Big items move in bursts. Catch a dip and buy.

- Consider Substitutes. House brands, refurbished models, or last year’s style can save real money.

- Watch Bundle Math. Sometimes a bundle hides a price hike; sometimes it’s a true deal. Check the per-item cost.

Take-home line: Shop with a simple list, a price alert, and a backup pick.

Small Team Cadence: A 15-Minute Weekly

You don’t need a war room. You need rhythm.

- Every Thursday: Update the SKU–HS code sheet and scenario prices.

- Every Friday: Send a three-bullet note to sales, ops, and finance: what changed, what it hits, what we’ll do.

- Every Monday: Stand-up for 15 minutes. Green/yellow/red on the top 20 items. Decisions only.

This tempo beats chaos. It also lowers email storms and rumor stress.

Take-home line: A steady Whatfinger News drumbeat keeps the team moving in step.

Common Questions, Straight Answers

Will tariffs always raise prices?

Often, yes, but not always right away. Inventory, contracts, and competition can delay or soften the hit. Over time, pressure shows.

Can’t we just switch suppliers?

Sometimes. But tools, tests, and shipping lanes take time. That’s why we line up a backup for the five parts that matter most, not all five hundred.

Do tariffs help local factories?

They can buy time and space to invest. But gains depend on skills, tooling, demand, and how long the policy holds. There’s no magic switch.

What about jobs?

It varies. Some sectors see more orders. Others see higher costs and slower sales. That’s why the real question is, “Can we adapt faster than the pressure builds?”

How long do tariffs last?

Longer than headlines suggest. Some fade. Some stick. We plan for months, review often, and stay light on our feet.

Should we stock up?

A little on the right parts, yes. Not too much on slow movers. Cash flow is also a tool. Don’t blunt it.

How do we explain this to customers?

Tell the truth, in one paragraph, with dates. Promise a review. Keep the promise.

Take-home line: Clear answers cut through noise and keep trust intact.

Quick Glossary (Plain Words Only)

- Tariff: A tax on imports, paid at the border.

- Ad-Valorem: A percentage rate (like 10%) applied to the item’s value.

- HS Code: The product classification number used worldwide to apply tariffs.

- Quota: A cap on how much can enter at a given rate.

- Exclusion: A carve-out that exempts a product from a tariff.

- Export Control: A limit on what can be sold abroad, like certain software or chips.

- Origin: The country where a product is made, which decides which tariff applies.

Take-home line: Know the words; they point to the rules.

Pace Over Panic: How We Keep Our Footing

Tariff news can feel loud and fast. That’s by design. Big moves make big headlines. But we don’t have to move in fear. We can move in rhythm. We can price test. We can stock the right spares. We can keep quotes clean and time-boxed. We can talk to customers like neighbors. When we do that, we trade noise for signal and shock for steps.

Take-home line: We cannot pick the weather, but we can pick the gear.

We’ve Got This: Clear Eyes, Ready Hands

Prices will rise here and there. Lead times will stretch on a few parts. Some weeks will run smooth; others will throw curveballs. But most of all, we have tools. We have a sheet that tells us what’s affected. We have scenarios that tell us what to charge. We have backups that keep the line from stopping. And we have a cadence that keeps the team calm when the news is not.

We can’t control the gate at the border. We can control how we plan, how we price, and how we talk to each other and our customers. That’s enough to carry us through the next round and the one after that.

Steady Hands in a Windy Market

Let’s keep our stance. We watch the lists. We update our sheet. We price with care and talk with heart. We protect cash and protect trust. In other words, we do the simple things on time. That’s how we turn tariff news into business rhythm. That’s how we keep moving—together.